How to Calculate Annuities Future Value: A Step-by-Step Guide

Are you looking to invest in an annuity but unsure of how to calculate its future value? Look no further! In this guide, we will walk you through the process of applying the formula and calculating the future value of an annuity.

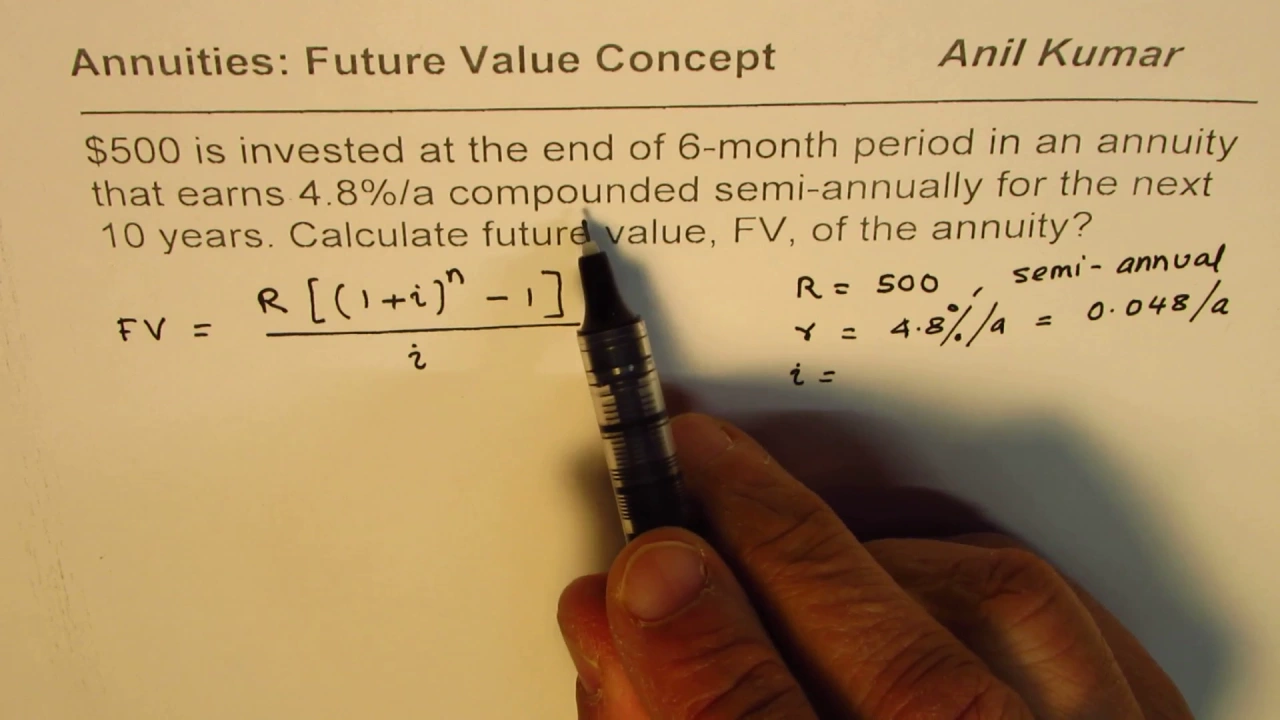

Understanding the Formula

Before we dive into the calculations, let's first understand the formula for future value. Future value is the recurring amount of money we deposit, multiplied by one plus the interest rate to the power of n minus 1, divided by the interest rate.

Example Calculation

Let's take an example to understand this better. Suppose you invest $500 at the end of a six-month period in an account that earns 4.8% per annum compounded semi-annually for the next ten years.

To calculate the future value of this annuity, we need to substitute the values in the formula.

- Recurring amount (R) = $500

- Interest rate (I) = 4.8% per annum compounded semi-annually, which is equal to 0.0244 in terms of I interest in the compounding period of semi-annual.

- Number of years (n) = 10, and since we are doing compounding twice in a year, the compounding periods (n) will be 2 times n, which is 20.

Now, we can substitute these values in the formula:

Future value = R x [(1 + I)^n - 1] / I

= $500 x [(1 + 0.0244)^20 - 1] / 0.0244

= $12,644.54

Therefore, the future value of the annuity is $12,644.54.

Calculating Interest Earned

Now that we have calculated the future value of the annuity, let's calculate the interest earned.

To do this, we need to subtract the deposit amount from the future value.

Deposit amount = $500 x 20 = $10,000

Interest earned = Future value - Deposit amount

= $12,644.54 - $10,000

= $2,644.54

Therefore, the interest earned on the annuity is $2,644.54.

Pros and Cons of Annuities

Annuities can be a great investment option for those looking for a steady stream of income in retirement. They offer tax-deferred growth and can provide a guaranteed income for life. However, they also come with some drawbacks.

One major drawback is that annuities can be expensive, with high fees and commissions. Additionally, they may not offer as much flexibility as other investment options.

Conclusion

Calculating the future value of an annuity may seem daunting at first, but with the right formula and a little bit of math, it can be done easily. Remember to consider the pros and cons of annuities before making any investment decisions.

Thank you for reading!

Highlights

- An annuity is an investment option that provides a steady stream of income in retirement.

- Future value is the recurring amount of money we deposit, multiplied by one plus the interest rate to the power of n minus 1, divided by the interest rate.

- To calculate the future value of an annuity, we need to know the recurring amount, interest rate, and number of years.

- Annuities offer tax-deferred growth and a guaranteed income for life, but they can be expensive and may not offer as much flexibility as other investment options.

FAQ

Q: What is an annuity?

A: An annuity is an investment option that provides a steady stream of income in retirement.

Q: How do I calculate the future value of an annuity?

A: To calculate the future value of an annuity, you need to know the recurring amount, interest rate, and number of years. You can use the formula: Future value = R x [(1 + I)^n - 1] / I.

Q: What are the pros and cons of annuities?

A: Annuities offer tax-deferred growth and a guaranteed income for life, but they can be expensive and may not offer as much flexibility as other investment options.