Table of Contents

1. Introduction

2. Understanding Customer Balance and Late Fees

- 2.1 Displaying Outstanding Balance and Late Fees

- 2.2 Adjusting Customer Balance

- 2.3 Clearing Credit Balance Errors

- 2.4 Exempting Customers from Late Fees

- 2.5 Charging House Fees

3. Updating Customer Status

- 3.1 Making Financial Adjustments

- 3.2 Password Protection for Major Adjustments

- 3.3 Writing an Invoice as a Posting Memo

- 3.4 Clearing Small Amounts

4. Conclusion

Introduction

In this article, we will explore the various aspects of managing customer balances and late fees. It is crucial for businesses to have a clear understanding of how to handle these financial aspects to maintain a healthy customer relationship. We will discuss the importance of displaying outstanding balances and late fees, as well as how to adjust customer balances and clear credit balance errors. Additionally, we will cover the option to exempt customers from late fees and the process of charging house fees. Finally, we will delve into updating customer status and making financial adjustments, including the use of password protection and writing invoices as posting memos.

Understanding Customer Balance and Late Fees

2.1 Displaying Outstanding Balance and Late Fees

To effectively manage customer accounts, it is essential to have a system in place that displays any outstanding balances and late fees. This feature provides transparency to both the business and the customer. By enabling this feature, businesses can keep track of the financial status of each customer and ensure timely payments. It also allows customers to stay informed about their current balance and any late fees they may have incurred.

2.2 Adjusting Customer Balance

Sometimes, there may be a need to adjust a customer's balance. This adjustment can be made to correct errors or address specific situations. For example, if a customer has a credit balance due to an overpayment or a refund, it can be cleared using the account adjustment feature. This ensures that the customer's balance accurately reflects their financial status.

2.3 Clearing Credit Balance Errors

In the event of a credit balance error, it is crucial to rectify the situation promptly. The account adjustment feature allows businesses to clear credit balance errors efficiently. By addressing these errors, businesses can maintain accurate financial records and prevent any discrepancies that may arise in the future.

2.4 Exempting Customers from Late Fees

Late fees can be a source of frustration for customers. However, businesses have the option to exempt certain customers from late fees. This can be done based on specific criteria or as a gesture of goodwill. By exempting customers from late fees, businesses can foster positive customer relationships and demonstrate flexibility in their policies.

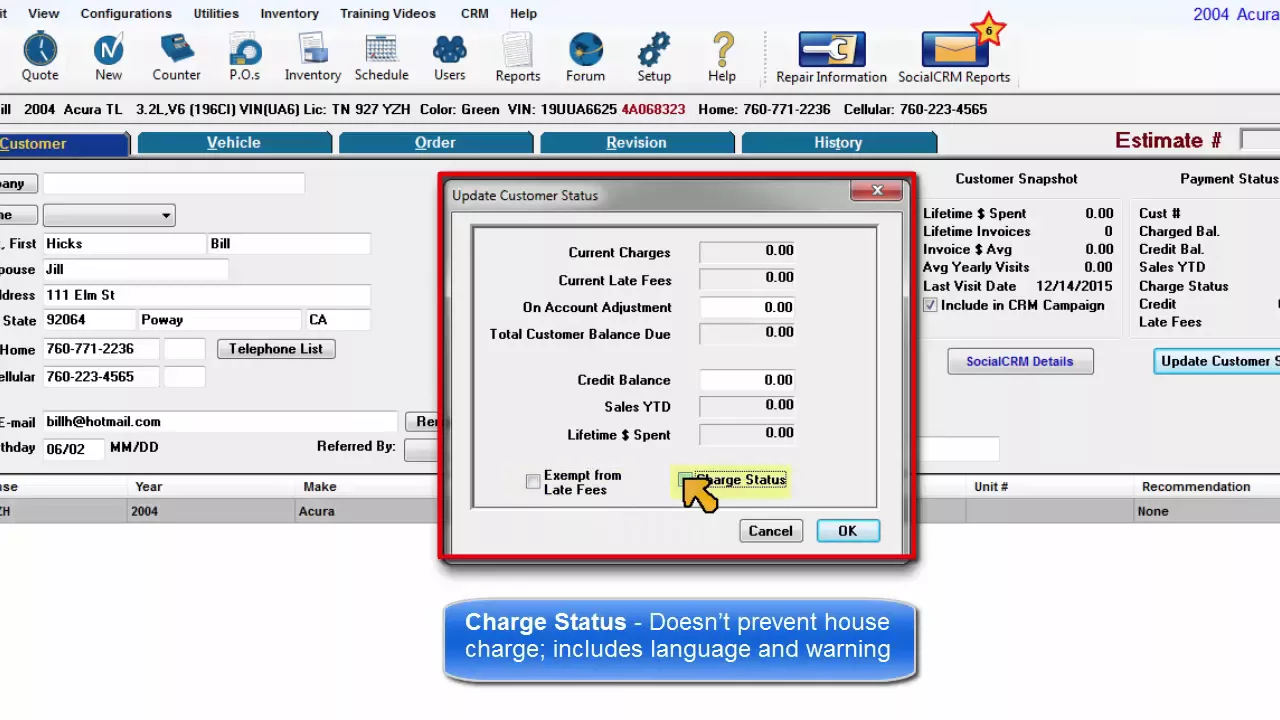

2.5 Charging House Fees

While charge status doesn't prevent a house charge, it includes language and warnings to inform customers about the associated fees. Charging house fees is a common practice in certain industries, and businesses need to communicate this clearly to customers. By implementing charge status, businesses can ensure that customers are aware of any additional fees they may incur.

Updating Customer Status

3.1 Making Financial Adjustments

Updating customer status allows businesses to make necessary financial adjustments. This feature is particularly useful when there is a need to modify a customer's account due to specific circumstances. It provides a quick and efficient means to affect customer balances and credits.

3.2 Password Protection for Major Adjustments

When making major adjustments to a customer's account, it is advisable to password-protect the process. This adds an extra layer of security and ensures that only authorized personnel can make significant changes. By implementing password protection, businesses can maintain control over financial adjustments and prevent unauthorized access.

3.3 Writing an Invoice as a Posting Memo

For major adjustments that require detailed documentation, writing an invoice as a posting memo is recommended. This practice ensures that there is a clear record of the adjustment, including all relevant details. By documenting the adjustment in this manner, businesses can maintain accurate financial records and have a reference for future audits or inquiries.

3.4 Clearing Small Amounts

In some cases, there may be a need to clear out very small amounts from a customer's account. This can be done efficiently using the on-hand adjustment feature. By clearing small amounts, businesses can maintain accurate financial records without the need for extensive documentation.

Conclusion

Managing customer balances and late fees is a crucial aspect of maintaining a healthy financial relationship with customers. By effectively displaying outstanding balances and late fees, adjusting customer balances, clearing credit balance errors, exempting customers from late fees, and charging house fees, businesses can ensure transparency and fairness in their financial dealings. Additionally, updating customer status, making financial adjustments, implementing password protection, writing invoices as posting memos, and clearing small amounts provide businesses with the necessary tools to manage customer accounts efficiently. By following these practices, businesses can foster positive customer relationships and maintain accurate financial records.

---

Highlights

- Understanding the importance of displaying outstanding balances and late fees

- Adjusting customer balances to maintain accurate financial records

- Clearing credit balance errors promptly and efficiently

- Exempting customers from late fees to foster positive relationships

- Charging house fees and communicating them effectively

- Updating customer status and making necessary financial adjustments

- Implementing password protection for major adjustments

- Writing invoices as posting memos for detailed documentation

- Clearing small amounts without extensive documentation

- Maintaining transparency and fairness in financial dealings

---

FAQ

**Q: Can customers view their outstanding balances and late fees?**

A: Yes, businesses can enable a feature that allows customers to view their current balance and any late fees they may have incurred.

**Q: How can businesses adjust a customer's balance?**

A: Businesses can use the account adjustment feature to make necessary adjustments to a customer's balance.

**Q: What should businesses do in case of a credit balance error?**

A: It is important for businesses to promptly clear credit balance errors using the account adjustment feature.

**Q: Can businesses exempt certain customers from late fees?**

A: Yes, businesses have the option to exempt specific customers from late fees based on certain criteria or as a gesture of goodwill.

**Q: What is the purpose of charging house fees?**

A: Charging house fees helps businesses cover additional costs associated with certain services or products.

**Q: How can businesses make financial adjustments to a customer's account?**

A: Businesses can update customer status and use the available features to make necessary financial adjustments.

**Q: Why is password protection recommended for major adjustments?**

A: Password protection adds an extra layer of security and ensures that only authorized personnel can make significant changes to a customer's account.

**Q: What is the benefit of writing an invoice as a posting memo?**

A: Writing an invoice as a posting memo provides detailed documentation of major adjustments, ensuring accurate financial records.

**Q: How can businesses clear small amounts from a customer's account?**

A: Businesses can use the on-hand adjustment feature to efficiently clear out very small amounts from a customer's account.

**Q: What are the key practices for managing customer balances and late fees?**

A: The key practices include displaying outstanding balances and late fees, adjusting customer balances, clearing credit balance errors, exempting customers from late fees, charging house fees, updating customer status, implementing password protection, writing invoices as posting memos, and clearing small amounts.

---

Resources:

- [AI Chatbot Product](https://www.voc.ai/product/ai-chatbot)